Gurstel Law Firm is a Debt Collections Law firm located in Golden Valley, MN. They often sue Minnesotans for unpaid debts from things like credit cards or medical bills.

A lawsuit in Minnesota starts with a Summons and Complaint. This is a legal document that is supposed to be served (handed to) the Defendant or a responsible looking adult at their last known address. A summons looks like the picture below.

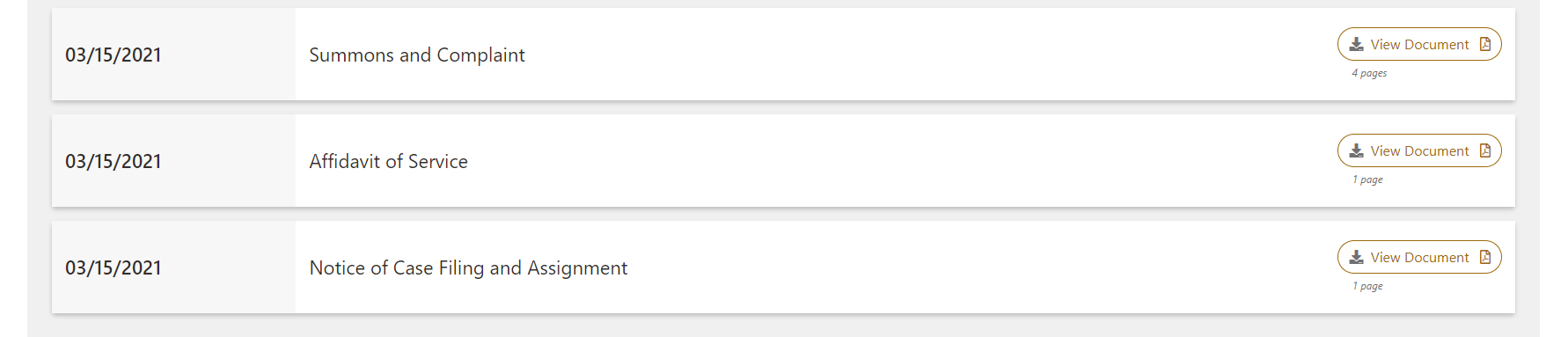

What happens if there is a lawsuit and you never got served? The first thing to do is look up the judgement and try to find something called the “affidavit of service.” You can find the case number on this website www.mncourts.gov just make sure to search by party, and not case! Then save the case number and search this second website. The second website lets you look at any document filed in the case. You want to find something called the “affidavit of service.” Here is a picture of the document.

That Affidavit of Service will say who got served with the Summons and Complaint. Don’t hesitate to call us if it’s an address that you don’t know. That’s illegal and we can bring a lawsuit on your behalf.

Most of the time, however, the service is done correctly. After the summons and complaint, you have an option to file an answer to prove to the court that the debt is not yours or is somehow not legitimate. For example, maybe you paid it already or it’s the debt of another person with the same name. To do this, you can file an “answer.” There is a filing fee of approximately $300 for this.

Most people don’t file an answer and Gurstel Law Firm will get a default judgment against you for the amount of the debt plus some attorney’s fees and interest. You will get another letter from the Minnesota Courts system saying ‘Notice of Entry and Docketing of Judgment.” This is how you know there is a judgment. This counts even if it goes to a former address. Only the initial summons and complaint has to be served on a responsible looking adult at your last known address.

30 days after the entry of the judgment, Gurstel Law Firm can freeze bank accounts with your name on them and garnish 25% of the net of your pay.

WHAT CAN YOU DO ABOUT THE JUDGMENT?

- You can bring a motion to vacate the judgment within 20 days of entry of the judgment. In a judgment for debt, this motion requires that you prove BOTH that you don’t owe the debt AND that you had a good reason not to fight it earlier.

- You can pay off or settle the judgment. Gurstel Law Firm will let you pay it off or maybe settle it for a lump sum. The judgment will still be on your credit reports, but it will be satisfied. Be careful if you go this route because you will still owe some taxes on it.

- You can file bankruptcy on it. Bankruptcy voids the judgment and allows your bankruptcy layer to remove the judgment lien from the county land records.

If you want to learn about bankruptcy, then either call us at (612) 824-4357 or choose a time online for a free consultation with an attorney (MN residents only).